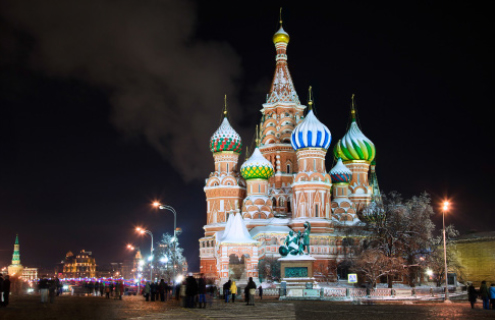

Russia

17 June 2015

Russia’s corporate actions reform if firmly underway, but there’s a lot of work left to do, and the political landscape could mean it’s going to be a rocky ride

Image: Shutterstock

Image: Shutterstock

Of all the major changes in Russia of late, the corporate actions reform might not have been the focus of the mainstream media. However, international sanctions aside, this huge legislative change is set to alter the investment management space in a big way.

The reform is primarily designed to reduce risk in corporate actions, making the National Securities Depository (NSD), Russia’s central securities depository, the single source for corporate actions communications, and creating electronic shareholder voting as standard. Rules are also set to change for international investors, all in aid of making the process automated and more cost-efficient.

Alexei Fedotov, head of securities and fund services at Citi Russia, calls the reform “the biggest area for improvement in Russia”, adding that it will also lead to greater transparency and better corporate governance overall.

He says: “It will dramatically change the investment climate in Russia as it will significantly reduce one of the biggest operational and corporate governance risks in the market.”

According to Maria Krasnova, deputy chairman of the executive board of NSD, these changes mean significant changes to the Russian marketplace as a whole. The current largely paper-based system will move towards automated services and straight-through processing. For the firms involved this means working together to create new standards, and Krasnova believes this is the first step towards reform.

“For now most of our activities are preparing the industry to move to new ways of interacting with each other,” she says.

“E-proxy is only the first step and it’s probably not that big from a market participant’s perspective, given the scale of the further changes.”

On a technical level, NSD introduced the ISO 20022 universal financial messaging scheme in April, and Fedotov anticipates the adoption of SWIFT and proprietary electronic systems in-house. While the effects of this might not be immediately obvious, it is, again, the beginning of a larger infrastructure change.

Krasnova says: “The difficulties now relate to establishment—engineering and the building up the new infrastructure.”

NSD also still supports ISO 15022 messaging for international parties that are unable to use ISO 20022, meaning it’s also providing a conversion service.

And there is much more in the pipeline. The Russian government is in the process of implementing a new law. It’s already had its first reading in parliament and, if all goes well, should come in to effect in 2016.

At the moment, corporate actions can only be processed using paper, and it’s clear that new technology is required—and available—to move the industry in to a new era of electronic messaging. According to Krasnova, the new law is required in order to ensure the new standards are implemented across the industry.

“It is important to get this law adopted as soon as possible so that the market participants are 100-percent sure that the changes are inevitable,” she says. “Only then can they start all the necessary preparation. What we intend to do will require major changes on their side both in legal and technological operations.”

It will be imperative that firms are ready for the final draft, in order to hit the ground running, but Krasnova appreciates the responsibility of NSD to keep them informed—in fact, NSD launched its online communication tool dedicated to the reforms in March, giving participants a space to voice any concerns and to make any suggestions.

Krasnova says: “When the law changes they will have to be ready. There is a lot of work to be done.”

“We will also have to be ready to communicate the new expectations regarding standards, so our participants can start development of their internal systems. They will need the information upfront so they can prepare, and it will require communication between the market participants and a lot of patience.”

Fedotov also highlights the importance of being properly prepared for the change, but suggests that it can be difficult to get things moving before the legislation is finalised.

He says: “Usually laws are followed by regulations which add details to principles stipulated by law. It is not clear whether such regulations will appear and when.”

“Global custodians and investors must get ready and adapt to new rules. That can only happen when the local market has all rules in place and procedures finalised.”

But Krasnova says that the Russian regulator is on board with the changes and even helping to push the new rules through parliament, ensuring that all changes are feasible and based on proper legal grounding.

Ultimately, he predicts a positive effect on corporate governance as a whole, as it establishes an infrastructure for electronic processing as standard in this area.

Under the current system, many shareholders find it too difficult to even cast their votes in significant decisions. The paperwork requires time and money to complete, authorise and return in time, and after a few missed deadlines, some are choosing not to bother at all.

Ordering electronic voting in law will mean that anyone with a right to vote will have relatively easy access to a quick way of doing so, either through a website or specialist online services.

Fedetov goes in to more detail, saying that shareholders can become disillusioned with the excessive administrative burden. He suggests that this red tape can even lead to inaccurate results from shareholder votes.

He says: “It is not a secret that the current paper-based corporate actions process is based on the 100-percent discretion of the issuer, which has the freedom to accept documents from the investor or reject them.”

“Anecdotal situations where investors are rejected due to the ‘wrong’ size of apostille on a document or a missing seal on a power-of-attorney are very well known, and are often used by issuers to manipulate corporate actions in accordance with their own agenda, or the agenda of a few major shareholders.”

“Streamlined electronic corporate actions procedures offered by the draft law eliminate issuers’ discretion and minimise corporate governance issue.”

And the new system is already proving to be in-demand. Sberbank, one of Russia’s largest shareholder-owned banks, has signed up to use NSD’s e-proxy voting in its 2015 AGM.

Krasnova says: “Sberbank was using voting instructions collected via our new ISO-based technology. They have been pioneering in this area, and the e-proxy voting is just the first step.”

Voting from a distance, even electronically, is likely to affect international investors, and it’s inevitable that politics must play a part. With international sanctions placing heavy restrictions on trade with Russia, it’s still unclear what the fate of Russian firms with international investment may be.

Nevertheless, the reform has been on the cards since before the political upheaval, and Krasnova maintains that the reform won’t be derailed.

She says: “We understand that some market participants may experience certain difficulties connected with sanctions.”

“We have to proceed with the reform—the changes we’re making are positive for both local and international communities. It is important to provide institutions with modern technology, so that when things get back to normal they are ready to maintain the volumes needed.”

Fedotov points out that, about a year ago, the Central Bank of Russia (CBR) identified more than 200 key performance indicators (KPIs), with corporate actions reforms featuring fairly highly on the list. If the sanctions are not lifted, then issuers will have to consider the way they deal with international investors—something that might be tricky to pull off in the middle of a reform process.

“Corporate actions reform is one of the top priority KPIs and both CBR and market participants continue working on it without any delays,” says Fedotov.

“Changes in processes will require a lot of time and effort, but are manageable. Prior to final approval of the law, it is still premature to say when all changes will be made, however, it is clear that the most challenging part will be on issuers’ side as they will need to seriously change their systems and processes, and changes cannot be invoked in the middle of any corporate action event.”

Whether the political landscape proves to be a blip or a deal-breaker remains to be seen, but it appears that NSD and industry players are keen to go ahead with the reform, even if optimism levels do vary. Either way, Russia is still relatively near the beginning of its corporate actions journey, and no adventure is complete without its setbacks.

The reform is primarily designed to reduce risk in corporate actions, making the National Securities Depository (NSD), Russia’s central securities depository, the single source for corporate actions communications, and creating electronic shareholder voting as standard. Rules are also set to change for international investors, all in aid of making the process automated and more cost-efficient.

Alexei Fedotov, head of securities and fund services at Citi Russia, calls the reform “the biggest area for improvement in Russia”, adding that it will also lead to greater transparency and better corporate governance overall.

He says: “It will dramatically change the investment climate in Russia as it will significantly reduce one of the biggest operational and corporate governance risks in the market.”

According to Maria Krasnova, deputy chairman of the executive board of NSD, these changes mean significant changes to the Russian marketplace as a whole. The current largely paper-based system will move towards automated services and straight-through processing. For the firms involved this means working together to create new standards, and Krasnova believes this is the first step towards reform.

“For now most of our activities are preparing the industry to move to new ways of interacting with each other,” she says.

“E-proxy is only the first step and it’s probably not that big from a market participant’s perspective, given the scale of the further changes.”

On a technical level, NSD introduced the ISO 20022 universal financial messaging scheme in April, and Fedotov anticipates the adoption of SWIFT and proprietary electronic systems in-house. While the effects of this might not be immediately obvious, it is, again, the beginning of a larger infrastructure change.

Krasnova says: “The difficulties now relate to establishment—engineering and the building up the new infrastructure.”

NSD also still supports ISO 15022 messaging for international parties that are unable to use ISO 20022, meaning it’s also providing a conversion service.

And there is much more in the pipeline. The Russian government is in the process of implementing a new law. It’s already had its first reading in parliament and, if all goes well, should come in to effect in 2016.

At the moment, corporate actions can only be processed using paper, and it’s clear that new technology is required—and available—to move the industry in to a new era of electronic messaging. According to Krasnova, the new law is required in order to ensure the new standards are implemented across the industry.

“It is important to get this law adopted as soon as possible so that the market participants are 100-percent sure that the changes are inevitable,” she says. “Only then can they start all the necessary preparation. What we intend to do will require major changes on their side both in legal and technological operations.”

It will be imperative that firms are ready for the final draft, in order to hit the ground running, but Krasnova appreciates the responsibility of NSD to keep them informed—in fact, NSD launched its online communication tool dedicated to the reforms in March, giving participants a space to voice any concerns and to make any suggestions.

Krasnova says: “When the law changes they will have to be ready. There is a lot of work to be done.”

“We will also have to be ready to communicate the new expectations regarding standards, so our participants can start development of their internal systems. They will need the information upfront so they can prepare, and it will require communication between the market participants and a lot of patience.”

Fedotov also highlights the importance of being properly prepared for the change, but suggests that it can be difficult to get things moving before the legislation is finalised.

He says: “Usually laws are followed by regulations which add details to principles stipulated by law. It is not clear whether such regulations will appear and when.”

“Global custodians and investors must get ready and adapt to new rules. That can only happen when the local market has all rules in place and procedures finalised.”

But Krasnova says that the Russian regulator is on board with the changes and even helping to push the new rules through parliament, ensuring that all changes are feasible and based on proper legal grounding.

Ultimately, he predicts a positive effect on corporate governance as a whole, as it establishes an infrastructure for electronic processing as standard in this area.

Under the current system, many shareholders find it too difficult to even cast their votes in significant decisions. The paperwork requires time and money to complete, authorise and return in time, and after a few missed deadlines, some are choosing not to bother at all.

Ordering electronic voting in law will mean that anyone with a right to vote will have relatively easy access to a quick way of doing so, either through a website or specialist online services.

Fedetov goes in to more detail, saying that shareholders can become disillusioned with the excessive administrative burden. He suggests that this red tape can even lead to inaccurate results from shareholder votes.

He says: “It is not a secret that the current paper-based corporate actions process is based on the 100-percent discretion of the issuer, which has the freedom to accept documents from the investor or reject them.”

“Anecdotal situations where investors are rejected due to the ‘wrong’ size of apostille on a document or a missing seal on a power-of-attorney are very well known, and are often used by issuers to manipulate corporate actions in accordance with their own agenda, or the agenda of a few major shareholders.”

“Streamlined electronic corporate actions procedures offered by the draft law eliminate issuers’ discretion and minimise corporate governance issue.”

And the new system is already proving to be in-demand. Sberbank, one of Russia’s largest shareholder-owned banks, has signed up to use NSD’s e-proxy voting in its 2015 AGM.

Krasnova says: “Sberbank was using voting instructions collected via our new ISO-based technology. They have been pioneering in this area, and the e-proxy voting is just the first step.”

Voting from a distance, even electronically, is likely to affect international investors, and it’s inevitable that politics must play a part. With international sanctions placing heavy restrictions on trade with Russia, it’s still unclear what the fate of Russian firms with international investment may be.

Nevertheless, the reform has been on the cards since before the political upheaval, and Krasnova maintains that the reform won’t be derailed.

She says: “We understand that some market participants may experience certain difficulties connected with sanctions.”

“We have to proceed with the reform—the changes we’re making are positive for both local and international communities. It is important to provide institutions with modern technology, so that when things get back to normal they are ready to maintain the volumes needed.”

Fedotov points out that, about a year ago, the Central Bank of Russia (CBR) identified more than 200 key performance indicators (KPIs), with corporate actions reforms featuring fairly highly on the list. If the sanctions are not lifted, then issuers will have to consider the way they deal with international investors—something that might be tricky to pull off in the middle of a reform process.

“Corporate actions reform is one of the top priority KPIs and both CBR and market participants continue working on it without any delays,” says Fedotov.

“Changes in processes will require a lot of time and effort, but are manageable. Prior to final approval of the law, it is still premature to say when all changes will be made, however, it is clear that the most challenging part will be on issuers’ side as they will need to seriously change their systems and processes, and changes cannot be invoked in the middle of any corporate action event.”

Whether the political landscape proves to be a blip or a deal-breaker remains to be seen, but it appears that NSD and industry players are keen to go ahead with the reform, even if optimism levels do vary. Either way, Russia is still relatively near the beginning of its corporate actions journey, and no adventure is complete without its setbacks.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times