Fragmented data at root of settlement fails, say SIBOS panellists

17 October 2022 Netherlands

Image: Igor Nikushin

Image: Igor Nikushin

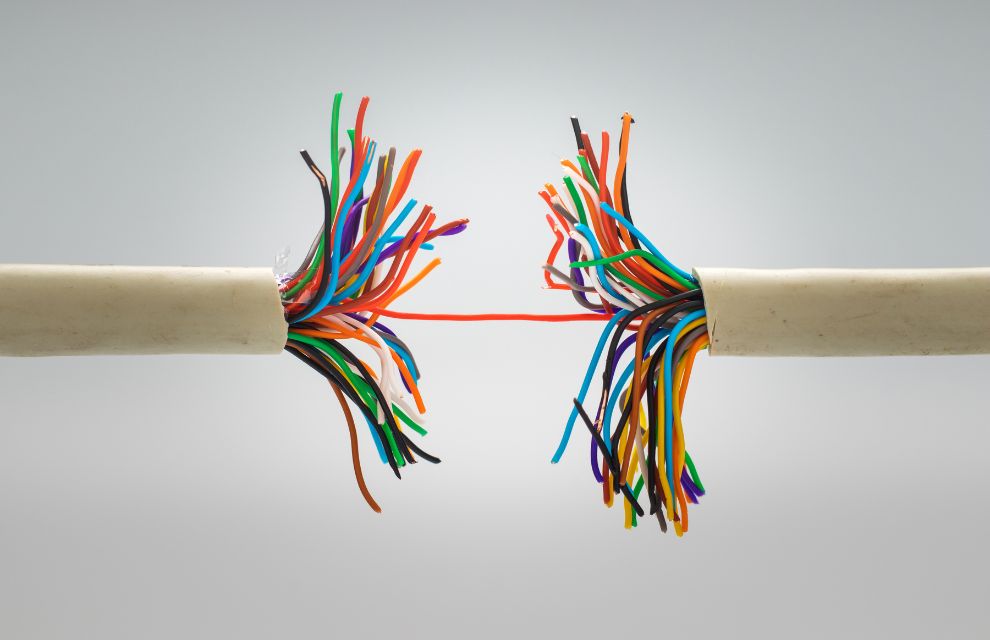

Fragmentation is a major factor in settlement fails, panellists at this year’s SIBOS conference agreed.

The comments came from a panel entitled ‘Tackling the root of securities settlement fails’, with participants trying to establish the cause of dropped global settlement efficiency rates.

Emma Johnson, executive director and global custody product manager at JP Morgan, stated that there were three main reasons for settlements to fail. The first was the operating structure, with a lack of transparency and fragmented processes causing difficulties. Market structure is also at fault, she said, with gaps in processes causing “ripples” through the settlement chain. A prominent cross-industry issue, incompatible data was also named as a cause for concern.

David Wouters, product manager at BNY Mellon, said that although communication between parties is “where the most time is spent to resolve things”, fragmentation remains a key issue.

Regulation was an inevitable topic on the table, with moderator Simon Daniel, senior securities product manager at Swift, pointing out that “it would not be a panel about settlement fails in Europe if we did not talk about regulation”.

Considering the impact of CSDR, Wouters stated that although there was initially a mild drop in settlement fails, the number has risen again as the regulation was adopted. Paul Baybutt, global head of middle office for securities services at HSBC, said that although there has been a “relapse” in the number of fails, the situation is “not as bad as it was before”. He suggested that the improvement seen as CSDR was implemented was a result of firms’ preparations for the regulation, with the focus on penalties prompting action.

However, he highlighted a significant issue with CSDR — partial settlements, a way to avoid complete fails, could incur a late matching penalty for buy-side firms. This is because to partially settle, both parties must amend their instructions, with buy-side amendments often entered after those of the sell-side. As a result, there is little incentive to take this route. He argued that “auto-partialing” is needed, where the penalty instead will lie with the party who fault to deliver overall.

Johnson stated that CSDR Refit would address some of these issues, with mandatory buy-ins (MBIs) a potential alteration that the updated regulation could see. Although it is unclear when this would be triggered, she suggested that if cash penalties are not effective then MBIs may be the next step.

Baybutt emphasised that the main issue prompting settlement fails is a lack of communication, with data not being linked together. Discussing the value of unique transaction identifiers (UTIs), he argued that these can bring this data together, allowing for a clearer picture of the process and making it simpler to identify the causes of fails. Summarising, Daniel added that in the short term UTIs can offer immediate visibility, and lead to actual change in the long run.

Identifying where problems are in the settlement process will be crucial as Europe moves to a T+1 cycle, Johnson commented. With overnight processes meaning that this shorter settlement cycle will leave little room for error, UTIs can allow the market to evolve its practice and standards to suit a more fast-paced environment.

Closing with a series of final advice for the audience, the panellists gave their solutions to avoiding settlement fails. Johnson posited that partial settlements are the way to go, and warned that auto-borrowing may be a dangerous path to take. Baybutt urged the industry to get through as much of the process at the pre-settlement stage as possible to maximise the chance of success, and finished with the caution that if settlements are not increased, firms risk facing yet another challenge — MBIs.

The comments came from a panel entitled ‘Tackling the root of securities settlement fails’, with participants trying to establish the cause of dropped global settlement efficiency rates.

Emma Johnson, executive director and global custody product manager at JP Morgan, stated that there were three main reasons for settlements to fail. The first was the operating structure, with a lack of transparency and fragmented processes causing difficulties. Market structure is also at fault, she said, with gaps in processes causing “ripples” through the settlement chain. A prominent cross-industry issue, incompatible data was also named as a cause for concern.

David Wouters, product manager at BNY Mellon, said that although communication between parties is “where the most time is spent to resolve things”, fragmentation remains a key issue.

Regulation was an inevitable topic on the table, with moderator Simon Daniel, senior securities product manager at Swift, pointing out that “it would not be a panel about settlement fails in Europe if we did not talk about regulation”.

Considering the impact of CSDR, Wouters stated that although there was initially a mild drop in settlement fails, the number has risen again as the regulation was adopted. Paul Baybutt, global head of middle office for securities services at HSBC, said that although there has been a “relapse” in the number of fails, the situation is “not as bad as it was before”. He suggested that the improvement seen as CSDR was implemented was a result of firms’ preparations for the regulation, with the focus on penalties prompting action.

However, he highlighted a significant issue with CSDR — partial settlements, a way to avoid complete fails, could incur a late matching penalty for buy-side firms. This is because to partially settle, both parties must amend their instructions, with buy-side amendments often entered after those of the sell-side. As a result, there is little incentive to take this route. He argued that “auto-partialing” is needed, where the penalty instead will lie with the party who fault to deliver overall.

Johnson stated that CSDR Refit would address some of these issues, with mandatory buy-ins (MBIs) a potential alteration that the updated regulation could see. Although it is unclear when this would be triggered, she suggested that if cash penalties are not effective then MBIs may be the next step.

Baybutt emphasised that the main issue prompting settlement fails is a lack of communication, with data not being linked together. Discussing the value of unique transaction identifiers (UTIs), he argued that these can bring this data together, allowing for a clearer picture of the process and making it simpler to identify the causes of fails. Summarising, Daniel added that in the short term UTIs can offer immediate visibility, and lead to actual change in the long run.

Identifying where problems are in the settlement process will be crucial as Europe moves to a T+1 cycle, Johnson commented. With overnight processes meaning that this shorter settlement cycle will leave little room for error, UTIs can allow the market to evolve its practice and standards to suit a more fast-paced environment.

Closing with a series of final advice for the audience, the panellists gave their solutions to avoiding settlement fails. Johnson posited that partial settlements are the way to go, and warned that auto-borrowing may be a dangerous path to take. Baybutt urged the industry to get through as much of the process at the pre-settlement stage as possible to maximise the chance of success, and finished with the caution that if settlements are not increased, firms risk facing yet another challenge — MBIs.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times