US SEC increases scrutiny on Coinbase

05 August 2022 US

Image: US Government

Image: US Government

At the end of July, the U.S. Securities and Exchange Commission (SEC) increased scrutiny on Coinbase, announcing an investigation into alleged securities laws violations.

Many industry participants say this could potentially spark a legal battle where the resulting consequences could affect the whole crypto landscape.

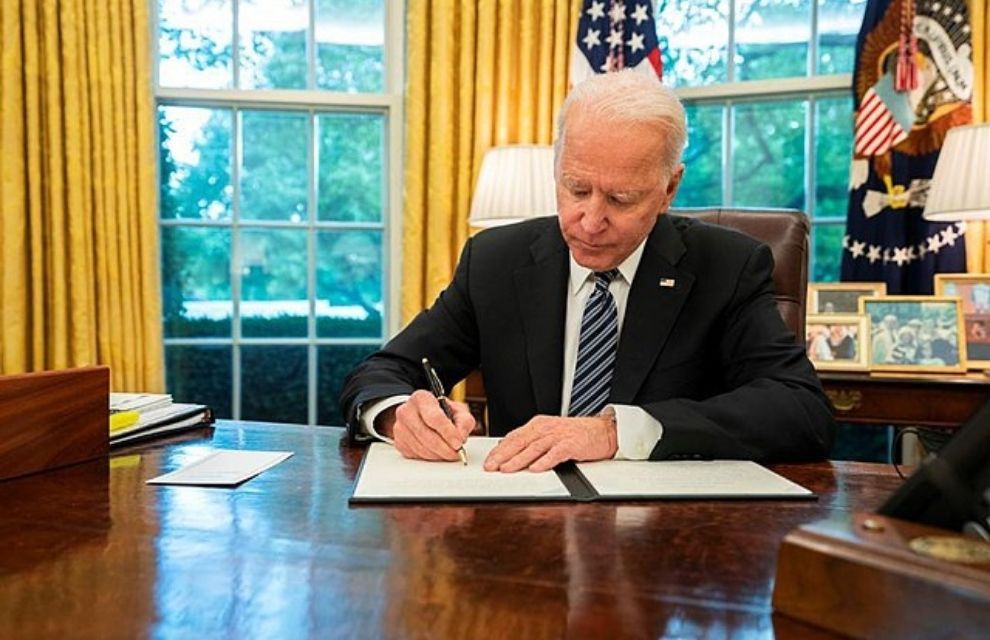

The controversy stems from the SEC’s action to implement amendments that standardise disclosures regarding cybersecurity risk management, as well as President Joe Biden’s signing of an executive order in March this year.

The president’s order highlights the US Government's commitment to ensuring that virtual assets and cryptocurrencies will be subject to further compliance measures with appropriate regulations and supervision.

In the executive order, Biden outlined: “We must mitigate the illicit finance and national security risks posed by misuse of digital assets. We must reinforce US leadership in the global financial system and in technological and economic competitiveness, including through the responsible development of payment innovations and digital assets. We must promote access to safe and affordable financial services.”

Commenting on the SEC’s increased scrutiny on Coinbase, David Newns, head of SIX Digital Exchange, says: “Classifying cryptocurrencies as securities potentially has very far-reaching implications on many areas including regulatory requirements for venues trading these assets, accounting, taxation, governance, and disclosure.

“Regulation should be looking at what each type of token represents as each crypto-asset has a different function and utility and will require their own set of regulation based on these functions. If all cryptocurrencies become securities, then we will see a major impact on the industry. Current crypto exchanges will need to be licensed securities trading platforms to provide trading in securities to US persons.”

Newns adds: “Let’s use the current market downturn to invest in building a strong infrastructure foundation for the crypto and digital asset markets, as well as a level of regulatory oversight that allows for innovation.”

Many industry participants say this could potentially spark a legal battle where the resulting consequences could affect the whole crypto landscape.

The controversy stems from the SEC’s action to implement amendments that standardise disclosures regarding cybersecurity risk management, as well as President Joe Biden’s signing of an executive order in March this year.

The president’s order highlights the US Government's commitment to ensuring that virtual assets and cryptocurrencies will be subject to further compliance measures with appropriate regulations and supervision.

In the executive order, Biden outlined: “We must mitigate the illicit finance and national security risks posed by misuse of digital assets. We must reinforce US leadership in the global financial system and in technological and economic competitiveness, including through the responsible development of payment innovations and digital assets. We must promote access to safe and affordable financial services.”

Commenting on the SEC’s increased scrutiny on Coinbase, David Newns, head of SIX Digital Exchange, says: “Classifying cryptocurrencies as securities potentially has very far-reaching implications on many areas including regulatory requirements for venues trading these assets, accounting, taxation, governance, and disclosure.

“Regulation should be looking at what each type of token represents as each crypto-asset has a different function and utility and will require their own set of regulation based on these functions. If all cryptocurrencies become securities, then we will see a major impact on the industry. Current crypto exchanges will need to be licensed securities trading platforms to provide trading in securities to US persons.”

Newns adds: “Let’s use the current market downturn to invest in building a strong infrastructure foundation for the crypto and digital asset markets, as well as a level of regulatory oversight that allows for innovation.”

← Previous digital assets article

abrdn to become largest external shareholder of UK’s first regulated digital securities exchange

abrdn to become largest external shareholder of UK’s first regulated digital securities exchange

NO FEE, NO RISK

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times