DTCC launches new capabilities to service

25 March 2025 US

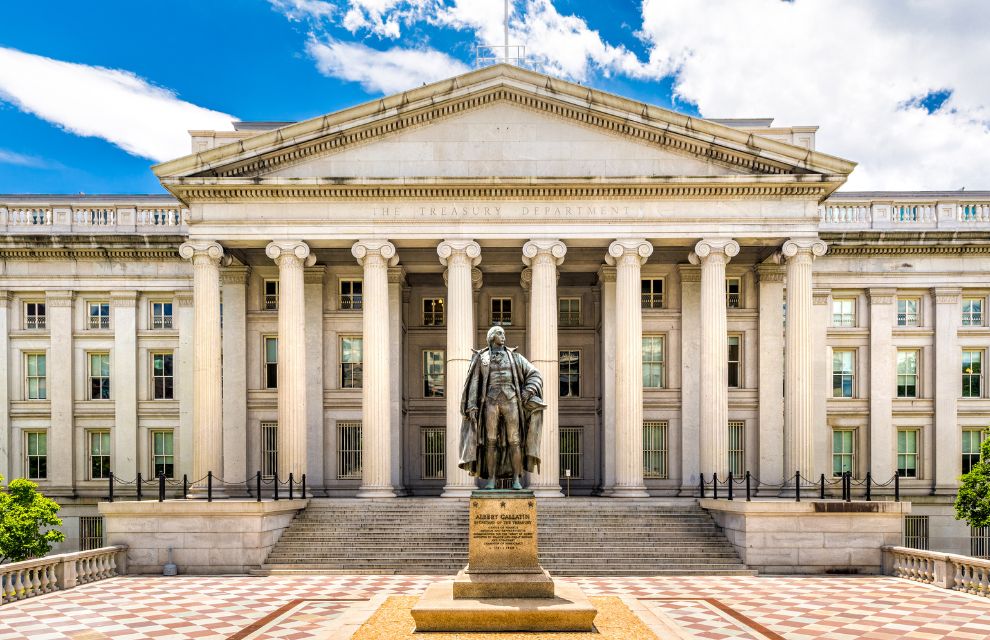

Image: mandritoiu/stock.adobe.com

Image: mandritoiu/stock.adobe.com

DTCC's Fixed Income Clearing Corporation (FICC) has launched new capabilities within its Agent Clearing Service.

These changes were made ahead of the SEC's deadline for mandatory clearing of covered US Treasury cash activity and repo activity, set for 31 March 2025.

The service will now be able to separate house and customer activities, as well as margin segregation for users choosing to post margin to FICC, says DTCC.

Robert Crain, managing director at FICC Market Risk, comments: "With this launch, FICC also enhanced its intraday monitoring processes to measure exposure changes in 15-minute increments.

“These capabilities will further reduce risk for participants as well as improve the safety and soundness of the US Treasury market.”

These changes were made ahead of the SEC's deadline for mandatory clearing of covered US Treasury cash activity and repo activity, set for 31 March 2025.

The service will now be able to separate house and customer activities, as well as margin segregation for users choosing to post margin to FICC, says DTCC.

Robert Crain, managing director at FICC Market Risk, comments: "With this launch, FICC also enhanced its intraday monitoring processes to measure exposure changes in 15-minute increments.

“These capabilities will further reduce risk for participants as well as improve the safety and soundness of the US Treasury market.”

NO FEE, NO RISK

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times