Goal Group launches Treaty Rate Manager

20 July 2021 US

Image: Goal Group

Image: Goal Group

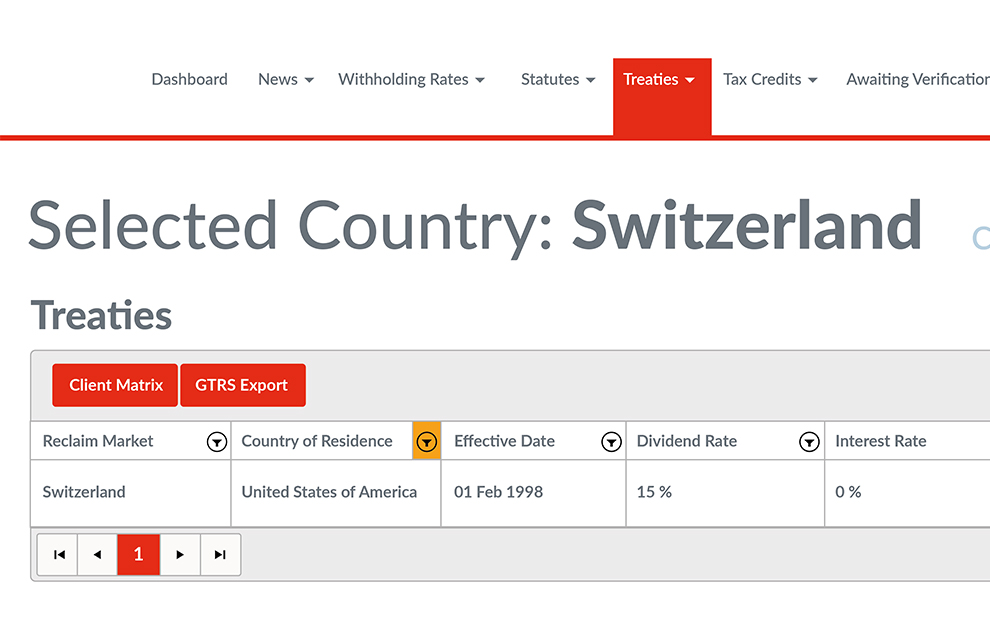

Goal Group has launched an online withholding tax reference database called Treaty Rate Manager (TRM), which provides access to the latest treaty rate information across the globe.

TRM includes all statutes of limitations and a simple-to-use tool to quickly determine the applicable treaty rate for a client by selecting their market of investment, domicile, entity type and security type.

Available immediately as a monthly subscription, it represents a valuable additional reference for fund managers, custodians, corporate actions systems vendors, research firms, the securities finance sector and other advisers involved in cross-border tax recovery and portfolio planning.

Goal Group and its worldwide client base use this data to feed up-to-date treaty rates into withholding tax reclaims on 3 billion shares annually.

The group says this is the first time it has offered access to its knowledge base on a standalone basis, and forms part of its new suite of innovative, web-based subscription services for the global investment community.

Stephen Everard, CEO of Goal Group, comments: “We are excited to present our withholding tax reference data to the market as a very competitively priced monthly subscription service.”

“Our own team relies on this data to deliver our market-leading outsourced reclaim service, and as such, its quality and scope is market-proven. Treaty data are continually updated by our in-house Research team and clients of TRM will benefit from this.”

According to Everard, building and maintaining the knowledge base required to calculate accurate tax reclaims – especially at volume - is simply not viable for most institutions. It makes far more economic sense to leverage the knowledge and dedicated resources of a third-party specialist.

“We anticipate strong demand from various sectors of the investment community as they sharpen their focus on maximising tax relief for clients, fully meeting their fiduciary duty and turning tax recovery into a lucrative service opportunity,” he adds.

TRM includes all statutes of limitations and a simple-to-use tool to quickly determine the applicable treaty rate for a client by selecting their market of investment, domicile, entity type and security type.

Available immediately as a monthly subscription, it represents a valuable additional reference for fund managers, custodians, corporate actions systems vendors, research firms, the securities finance sector and other advisers involved in cross-border tax recovery and portfolio planning.

Goal Group and its worldwide client base use this data to feed up-to-date treaty rates into withholding tax reclaims on 3 billion shares annually.

The group says this is the first time it has offered access to its knowledge base on a standalone basis, and forms part of its new suite of innovative, web-based subscription services for the global investment community.

Stephen Everard, CEO of Goal Group, comments: “We are excited to present our withholding tax reference data to the market as a very competitively priced monthly subscription service.”

“Our own team relies on this data to deliver our market-leading outsourced reclaim service, and as such, its quality and scope is market-proven. Treaty data are continually updated by our in-house Research team and clients of TRM will benefit from this.”

According to Everard, building and maintaining the knowledge base required to calculate accurate tax reclaims – especially at volume - is simply not viable for most institutions. It makes far more economic sense to leverage the knowledge and dedicated resources of a third-party specialist.

“We anticipate strong demand from various sectors of the investment community as they sharpen their focus on maximising tax relief for clients, fully meeting their fiduciary duty and turning tax recovery into a lucrative service opportunity,” he adds.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times