Guernsey signs MoU with China

19 November 2013 China

Image: Shutterstock

Image: Shutterstock

Guernsey’s financial services regulator, the Guernsey Financial Services Commission (GFSC), has signed a memorandum of understanding with the Chinese Securities Regulatory Commission (CSRC).

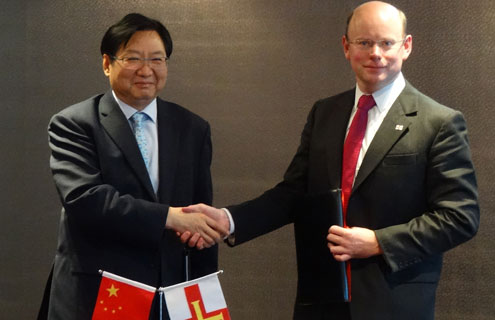

The agreement has been signed by William Mason, director general of the Guernsey commission, and Xiao Gang, Chairman of the Chinese commission.

Mason said: “Guernsey has high regulatory standards and this has been demonstrated to, and recognised by, the [Chinese commission] during the course of our discussions which have culminated in signing the MoU. The MoU provides the basis for a framework of cooperation and exchange of information between the two sets of authorities in relation to securities and futures business.”

The MoU sets out a statement of intent to establish a framework for mutual assistance and to facilitate the exchange of information between the authorities to ensure compliance with their respective securities and futures laws or regulatory requirements in order to promote investor protection and the integrity of the investment products.

Mason added: “Guernsey’s financial services business is becoming ever more global and as such, it is vital that we ensure agreements such as these are in place to facilitate effective regulation and supervision going forward."

"Importantly, this MoU is also a prerequisite for Guernsey domiciled funds receiving a licence from the CSRC under the Qualified Foreign Institutional Investor (QFII) regime which provides a quota for external investment into Chinese capital markets.”

The GFSC signed a similar agreement with the China Banking Regulatory Commission in 2011.

The agreement has been signed by William Mason, director general of the Guernsey commission, and Xiao Gang, Chairman of the Chinese commission.

Mason said: “Guernsey has high regulatory standards and this has been demonstrated to, and recognised by, the [Chinese commission] during the course of our discussions which have culminated in signing the MoU. The MoU provides the basis for a framework of cooperation and exchange of information between the two sets of authorities in relation to securities and futures business.”

The MoU sets out a statement of intent to establish a framework for mutual assistance and to facilitate the exchange of information between the authorities to ensure compliance with their respective securities and futures laws or regulatory requirements in order to promote investor protection and the integrity of the investment products.

Mason added: “Guernsey’s financial services business is becoming ever more global and as such, it is vital that we ensure agreements such as these are in place to facilitate effective regulation and supervision going forward."

"Importantly, this MoU is also a prerequisite for Guernsey domiciled funds receiving a licence from the CSRC under the Qualified Foreign Institutional Investor (QFII) regime which provides a quota for external investment into Chinese capital markets.”

The GFSC signed a similar agreement with the China Banking Regulatory Commission in 2011.

NO FEE, NO RISK

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times