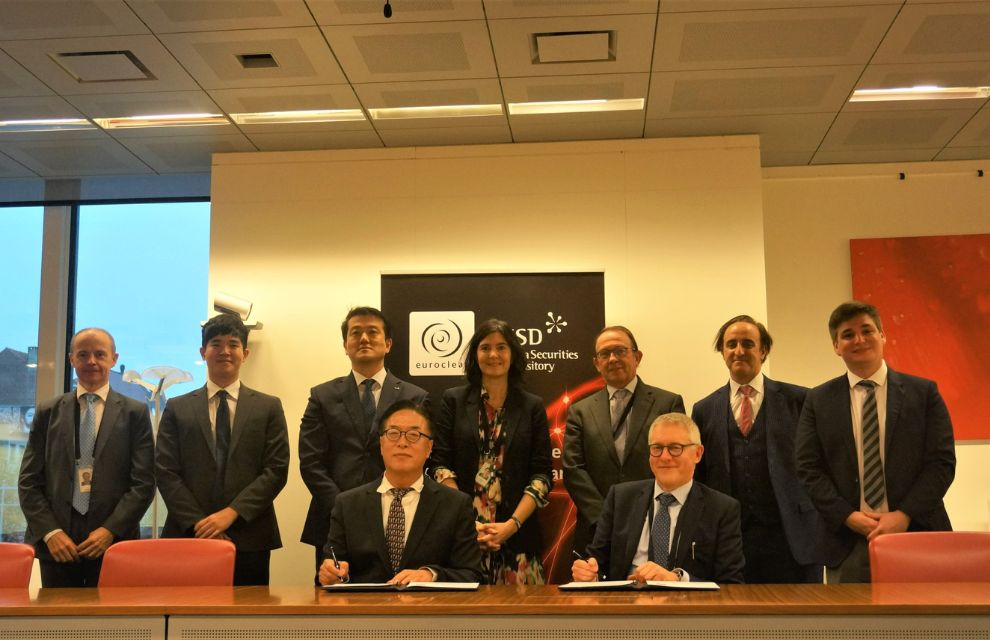

Euroclear Bank has signed a memorandum of understanding (MOU) with Korea Securities Depository (KSD), with the intention of providing more efficient post-trade access to Korea Treasury bonds for international investors.

The two firms will work to foster local market conditions that will support a ‘Euroclearable’ cross-border link, Euroclear says.

Korea has taken several steps to increase foreign investments, including the introduction of a Tax Revision Bill for non-residents and foreign corporations earlier this year.

Peter Sneyers, CEO of Euroclear Bank, says: “Korea’s capital markets have made great strides recently to encourage foreign investment. As a financial market infrastructure, we will continue to support and work closely with the market in its journey to include Korea Treasury bonds into the World Global Bond Index.”

Myongho Rhee, chairman and CEO of KSD, comments: “Today’s MOU is a way to reaffirm our commitment to the implementation of omnibus accounts for Korea Treasury bonds and monetary stabilisation bonds to signal our intention to accelerate our collaboration. Through this MOU, Euroclear and KSD will be able to build a robust partnership. I look forward to the future we will create together.”