Power to the people

05th April 2017

The R&M Investor Services Survey gives investment managers and asset owners the chance to voice their opinions on their providers, and this year’s results put client relationships at the heart of the business

Image: Shutterstock

Image: Shutterstock

The annual R&M Investor Services survey pits financial services providers up against one another, quizzing clients from around the world on everything from corporate actions and relationship management to securities lending and breadth of network.

While this year’s results threw up some surprises, the overall winners’ table arguably did not (see Figure 1). Pictet emerged as the winner, pulling ahead of the Royal Bank of Canada (RBC), which it held joint-first place with last year. However, both banks saw a slight drop in their overall scores. While each scored an average of 6.29 out of 7.00 in 2016, this year Pictet scored 6.24, getting the edge over RBC’s 6.06.

bFigure 1: Overall Score/b

font face="Roboto" size="2" color="#000000"Northern Trust retained its third-place position, while BNY Mellon and J.P. Morgan came in at fourth and fifth, respectively, and at the lower end of the table were BNP Paribas and State Street, scoring 5.38 and 5.12, respectively.

Survey responses from Pictet clients called the provider “very helpful” and “very reliable”, praising it for “enabling us to provide best services for our clients”. Similarly, an RBC client called the bank an “excellent service provider”, drawing particular attention to its “outstanding customer service”.

At the other end of the scale were comments from State Street clients citing responsiveness that is “slow relative to other custodians” and foreign exchange rates that are “too expensive”.

While the order of the overall leaderboard was not drastically different to in 2016, what is notable is that every service provider scored lower than it did in 2016. As Richard Hogsflesh, managing director of R&M Consultants, noted when presenting the results, R&M could not produce its usual ranking of ‘most improved’ banks, “because no bank did”.

Pictet’s score dropped by a marginal 0.05 points, however, RBC saw a much more significant dip of 0.23, with its second-place position perhaps proving testament to the strength of its score last year. BNP Paribas saw the biggest drop in score, falling by 0.26 points to 5.38.

Hogsflesh suggested that, historically, low scoring years have coincided with dips in stock market values, but this year that is not the case. He speculated that, rather, the general overall decline in satisfaction could be down the continuing pressure to comply with regulation. Alternatively, it could reflect budget cutbacks at the providers, stretching client service to the limit.

bExpert opinion/b

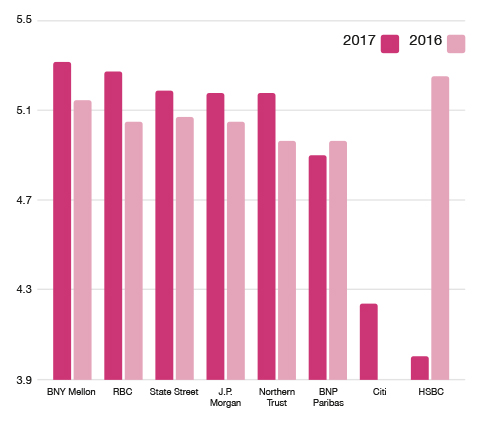

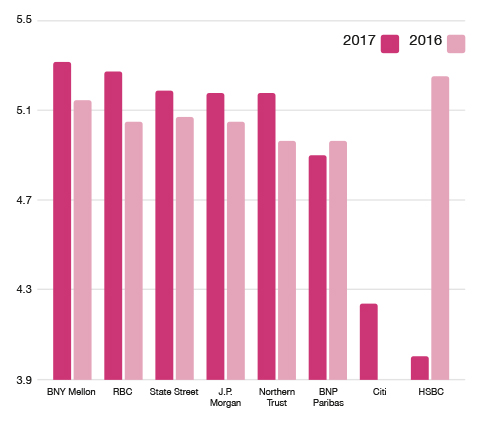

When it comes to ‘the experts’ results, that is, results from respondents that work with five or more providers, BNY Mellon redeemed itself, as did State Street (see Figure 2).

a href="http://www.assetservicingtimes.com/astimes/images/fig2a.jpg" target=“_blank "style="text-decoration:none">

Figure 2: The Experts

BNY Mellon found itself at the top of the table with an average score of 5.23, slightly up on last year’s score, which landed it in second place.

RBC jumped from fourth place in 2016 to second, with a score of 5.19, while State Street retained the third-place spot with 5.11.

In general, overall scores were lower in this subset, perhaps illustrating the unique ability of these respondents to make a proper comparison between providers. However, HSBC’s score of just 4.00 came as a particular shock, as it fell from first place in 2016, with a score of 5.17, into eighth place this year, in what Hogsflesh called “a big tumble for them”.

20Citi also scored poorly, coming in seventh place with a score of 4.22. Hogsflesh noted that R&M struggled to get many responses in for either Citi or HSBC, meaning they didn’t feature heavily in the results. He added, however, that those results that did come in were largely critical.

HSBC’s spectacular fall from grace could be partly attributed to client aversion to change. One respondent noted: “An internal reorganisation at HSBC changed our client service/relationship manager and they have not been as good as original team [sic].”

However, this is not the only issue. Elsewhere it was claimed that HSBC “do not adhere to best practice for corporate actions”, while “payment of cash following optional dividends is frequently delayed”, and the bank’s tax reclaim reporting was called “not as detailed or timely as peers”.

A Citi client was similarly scathing, saying: “Citi cope with the day to day queries well, but struggle with anything that falls outside the norm. There is a lack of urgency to progress issues, with far too many layers of management to get anything done quickly.”

Top of the chain

A further subset of results considers only responses from the top 200 asset management firms, as ranked by Investment & Pensions Europe (see Figure 3).

bFigure 3: Top 200 Asset Managers/b

Here, J.P. Morgan jumped to first place with a score of 5.39, up from third place last year. This was followed by last year’s number one, Northern Trust, with 5.37, while State Street came in last place with 5.06. It is interesting to note the minimal difference between these scores, with only 0.33 separating first and last position.

Client comments serve to shed a little more light on this, with one respondent claiming to have a “long lasting relationship with J.P. Morgan built on mutual expertise, quality and trust”, adding that the bank is “our preferred global custodian”.

Sentiments regarding State Street are not quite as warm but, despite the concerns around responsiveness and costs, one client suggested that its “service has gotten much better”, and another praised its network management team, saying it “actively responds to queries and requests for information”.

bCrossing borders/b

It is perhaps also interesting to note that Pictet appeared in neither of the two latter results tables, due to not enough responses being submitted from its clients. That said, Pictet does appear to have a significant global reach, scoring the highest in North America, Australasia and the ‘rest of world’ category, including the Asia Pacific region, South America and, for the first time, respondents from Papua New Guinea.

Pictet also came in second place in the UK, mainland Europe and Switzerland, only failing to reach the top two in the Nordics, where it did not appear at all.

In the UK, RBC came in first place, while in mainland Europe and Switzerland, the top spot was taken by Credit Suisse.

In fact, although Credit Suisse did not appear in many of the regional breakdowns, because it didn’t qualify in many geographies, in the two it did feature in it topped the list, proving itself memorable for all the right reasons.

One Credit Suisse client said they have had no serious issues over the last 12 months, adding that any minor issues have been solved in a manner that is “timely and to our complete satisfaction”. The same respondent also specifically mentioned an “excellent contact” at the bank, and praised support on open trades and email response time.

Credit Suisse was also the clear winner among asset manager and asset owner respondents. Among asset managers, it topped the table with an average score of 6.69, while among asset owners it scored a huge 6.88 out of 7.00, improving very slightly on last year’s score of 6.85.

Performing a little less well, globally, were State Street, BNP Paribas and BNY Mellon, despite the latter’s success in the experts category.

One respondent suggested BNY Mellon’s services could be affected because of heavy workloads. Although client engagement has improved, they said, this will “pale into insignificance unless they ensure relationship managers are appropriately resourced and equipped”.

Another was less understanding, saying: “Out of the relationships we have, BNY Mellon consistently cause us the most issues in most areas. They do not have the infrastructure to turn queries around quickly enough, with too many answers having to be double checked or sent back as they are not complete.”

Yet another noted: “Client care is quite poor”.

bStaying in touch/b

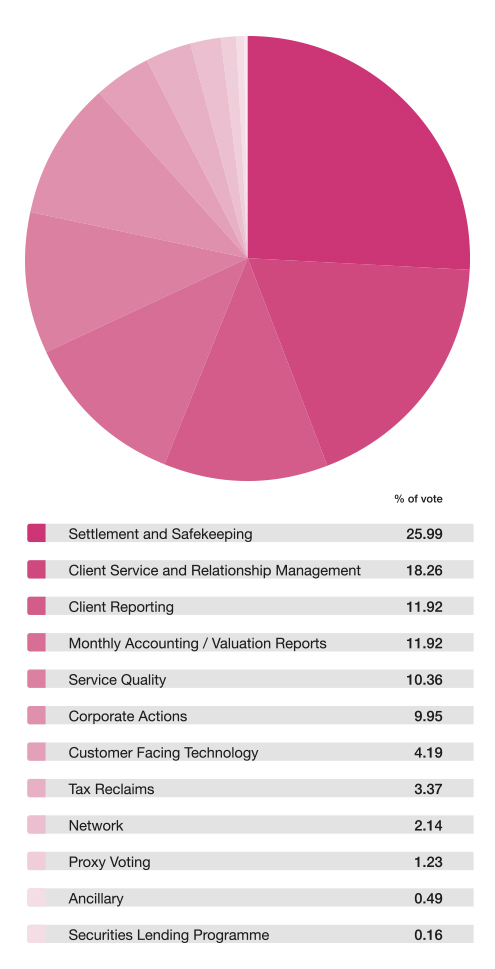

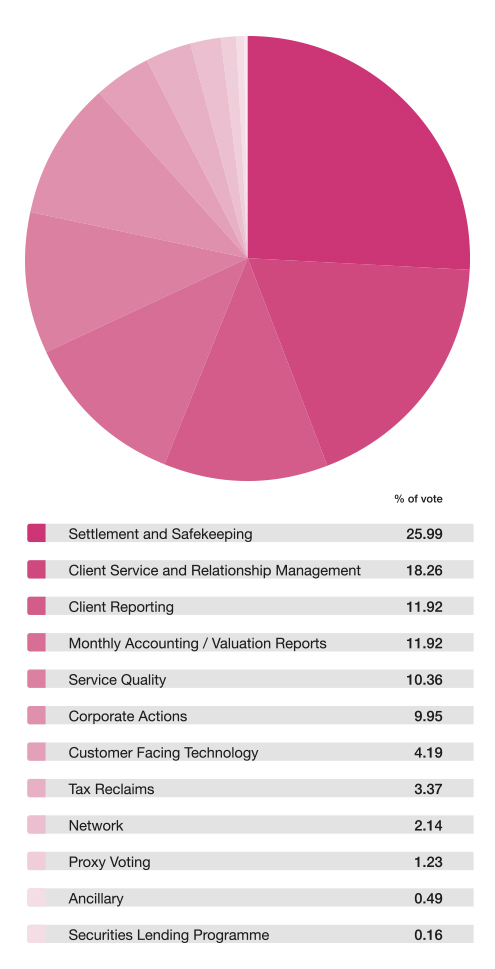

Finally, for the first time, respondents were asked to select the three service elements they consider to be the most important. The most valued service emerged as settlement and safekeeping, which Hogsflesh called “the core of the business”, and which received 25.99 percent of the vote (see Figure 4).

a href="http://www.assetservicingtimes.com/astimes/images/fig4a.jpg" target=“_blank "style="text-decoration:none">

Figure 4: Service Category

This was followed by client service and relationship management, named by 18.26 percent, and then client reporting, and monthly accounting and valuation reporting, which received 11.92 percent of the votes apiece.

The importance placed on client relationships was an ongoing theme that also came across in many of the comments, with one respondent saying: “At the end of the day, it’s the people make the difference [sic].”

Other comments suggested that, while relationship managers are good at their jobs and valued by clients, a lack of resources means they’re stretched, and this is affecting the service they can deliver.

Hogsflesh summed up, saying: “Quality of client service and relationship management is the biggest differentiator between providers. That has always been the case, and it continues to be the case.”

“Providers tend to be very large organisations and things are much more automated than they used to be, but at the end of the day, this is still a people business.”

Click Here for Results Tables

While this year’s results threw up some surprises, the overall winners’ table arguably did not (see Figure 1). Pictet emerged as the winner, pulling ahead of the Royal Bank of Canada (RBC), which it held joint-first place with last year. However, both banks saw a slight drop in their overall scores. While each scored an average of 6.29 out of 7.00 in 2016, this year Pictet scored 6.24, getting the edge over RBC’s 6.06.

bFigure 1: Overall Score/b

font face="Roboto" size="2" color="#000000"Northern Trust retained its third-place position, while BNY Mellon and J.P. Morgan came in at fourth and fifth, respectively, and at the lower end of the table were BNP Paribas and State Street, scoring 5.38 and 5.12, respectively.

Survey responses from Pictet clients called the provider “very helpful” and “very reliable”, praising it for “enabling us to provide best services for our clients”. Similarly, an RBC client called the bank an “excellent service provider”, drawing particular attention to its “outstanding customer service”.

At the other end of the scale were comments from State Street clients citing responsiveness that is “slow relative to other custodians” and foreign exchange rates that are “too expensive”.

While the order of the overall leaderboard was not drastically different to in 2016, what is notable is that every service provider scored lower than it did in 2016. As Richard Hogsflesh, managing director of R&M Consultants, noted when presenting the results, R&M could not produce its usual ranking of ‘most improved’ banks, “because no bank did”.

Pictet’s score dropped by a marginal 0.05 points, however, RBC saw a much more significant dip of 0.23, with its second-place position perhaps proving testament to the strength of its score last year. BNP Paribas saw the biggest drop in score, falling by 0.26 points to 5.38.

Hogsflesh suggested that, historically, low scoring years have coincided with dips in stock market values, but this year that is not the case. He speculated that, rather, the general overall decline in satisfaction could be down the continuing pressure to comply with regulation. Alternatively, it could reflect budget cutbacks at the providers, stretching client service to the limit.

bExpert opinion/b

When it comes to ‘the experts’ results, that is, results from respondents that work with five or more providers, BNY Mellon redeemed itself, as did State Street (see Figure 2).

a href="http://www.assetservicingtimes.com/astimes/images/fig2a.jpg" target=“_blank "style="text-decoration:none">

Figure 2: The Experts

BNY Mellon found itself at the top of the table with an average score of 5.23, slightly up on last year’s score, which landed it in second place.

RBC jumped from fourth place in 2016 to second, with a score of 5.19, while State Street retained the third-place spot with 5.11.

In general, overall scores were lower in this subset, perhaps illustrating the unique ability of these respondents to make a proper comparison between providers. However, HSBC’s score of just 4.00 came as a particular shock, as it fell from first place in 2016, with a score of 5.17, into eighth place this year, in what Hogsflesh called “a big tumble for them”.

20Citi also scored poorly, coming in seventh place with a score of 4.22. Hogsflesh noted that R&M struggled to get many responses in for either Citi or HSBC, meaning they didn’t feature heavily in the results. He added, however, that those results that did come in were largely critical.

HSBC’s spectacular fall from grace could be partly attributed to client aversion to change. One respondent noted: “An internal reorganisation at HSBC changed our client service/relationship manager and they have not been as good as original team [sic].”

However, this is not the only issue. Elsewhere it was claimed that HSBC “do not adhere to best practice for corporate actions”, while “payment of cash following optional dividends is frequently delayed”, and the bank’s tax reclaim reporting was called “not as detailed or timely as peers”.

A Citi client was similarly scathing, saying: “Citi cope with the day to day queries well, but struggle with anything that falls outside the norm. There is a lack of urgency to progress issues, with far too many layers of management to get anything done quickly.”

Top of the chain

A further subset of results considers only responses from the top 200 asset management firms, as ranked by Investment & Pensions Europe (see Figure 3).

bFigure 3: Top 200 Asset Managers/b

Here, J.P. Morgan jumped to first place with a score of 5.39, up from third place last year. This was followed by last year’s number one, Northern Trust, with 5.37, while State Street came in last place with 5.06. It is interesting to note the minimal difference between these scores, with only 0.33 separating first and last position.

Client comments serve to shed a little more light on this, with one respondent claiming to have a “long lasting relationship with J.P. Morgan built on mutual expertise, quality and trust”, adding that the bank is “our preferred global custodian”.

Sentiments regarding State Street are not quite as warm but, despite the concerns around responsiveness and costs, one client suggested that its “service has gotten much better”, and another praised its network management team, saying it “actively responds to queries and requests for information”.

bCrossing borders/b

It is perhaps also interesting to note that Pictet appeared in neither of the two latter results tables, due to not enough responses being submitted from its clients. That said, Pictet does appear to have a significant global reach, scoring the highest in North America, Australasia and the ‘rest of world’ category, including the Asia Pacific region, South America and, for the first time, respondents from Papua New Guinea.

Pictet also came in second place in the UK, mainland Europe and Switzerland, only failing to reach the top two in the Nordics, where it did not appear at all.

In the UK, RBC came in first place, while in mainland Europe and Switzerland, the top spot was taken by Credit Suisse.

In fact, although Credit Suisse did not appear in many of the regional breakdowns, because it didn’t qualify in many geographies, in the two it did feature in it topped the list, proving itself memorable for all the right reasons.

One Credit Suisse client said they have had no serious issues over the last 12 months, adding that any minor issues have been solved in a manner that is “timely and to our complete satisfaction”. The same respondent also specifically mentioned an “excellent contact” at the bank, and praised support on open trades and email response time.

Credit Suisse was also the clear winner among asset manager and asset owner respondents. Among asset managers, it topped the table with an average score of 6.69, while among asset owners it scored a huge 6.88 out of 7.00, improving very slightly on last year’s score of 6.85.

Performing a little less well, globally, were State Street, BNP Paribas and BNY Mellon, despite the latter’s success in the experts category.

One respondent suggested BNY Mellon’s services could be affected because of heavy workloads. Although client engagement has improved, they said, this will “pale into insignificance unless they ensure relationship managers are appropriately resourced and equipped”.

Another was less understanding, saying: “Out of the relationships we have, BNY Mellon consistently cause us the most issues in most areas. They do not have the infrastructure to turn queries around quickly enough, with too many answers having to be double checked or sent back as they are not complete.”

Yet another noted: “Client care is quite poor”.

bStaying in touch/b

Finally, for the first time, respondents were asked to select the three service elements they consider to be the most important. The most valued service emerged as settlement and safekeeping, which Hogsflesh called “the core of the business”, and which received 25.99 percent of the vote (see Figure 4).

a href="http://www.assetservicingtimes.com/astimes/images/fig4a.jpg" target=“_blank "style="text-decoration:none">

Figure 4: Service Category

This was followed by client service and relationship management, named by 18.26 percent, and then client reporting, and monthly accounting and valuation reporting, which received 11.92 percent of the votes apiece.

The importance placed on client relationships was an ongoing theme that also came across in many of the comments, with one respondent saying: “At the end of the day, it’s the people make the difference [sic].”

Other comments suggested that, while relationship managers are good at their jobs and valued by clients, a lack of resources means they’re stretched, and this is affecting the service they can deliver.

Hogsflesh summed up, saying: “Quality of client service and relationship management is the biggest differentiator between providers. That has always been the case, and it continues to be the case.”

“Providers tend to be very large organisations and things are much more automated than they used to be, but at the end of the day, this is still a people business.”

Click Here for Results Tables

NO FEE, NO RISK

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times