AccessFintech integrates with S&P Global Market Intelligence

AccessFintech integrates with S&P Global Market Intelligence

Reeves confirms date for shift to T+1 settlement

Reeves confirms date for shift to T+1 settlement

UK T+1 Accelerated Settlement Taskforce confirm implementation plan

UK T+1 Accelerated Settlement Taskforce confirm implementation plan

UK Accelerated Settlement Taskforce proposes T+1 transition date

UK Accelerated Settlement Taskforce proposes T+1 transition date

Swiss Securities Post-Trade Council sets T+1 move for October 2027

Swiss Securities Post-Trade Council sets T+1 move for October 2027

Authorities welcome new governance structure for T+1 transition in EU

Authorities welcome new governance structure for T+1 transition in EU

Sabatini to act as Independent Industry Chair for EU shift to T+1

Sabatini to act as Independent Industry Chair for EU shift to T+1

ESMA proposes ‘coordinated’ EU move to T+1 by October 2027

ESMA proposes ‘coordinated’ EU move to T+1 by October 2027

Higo Bank selects DTCC’s ITP Services

Higo Bank selects DTCC’s ITP Services

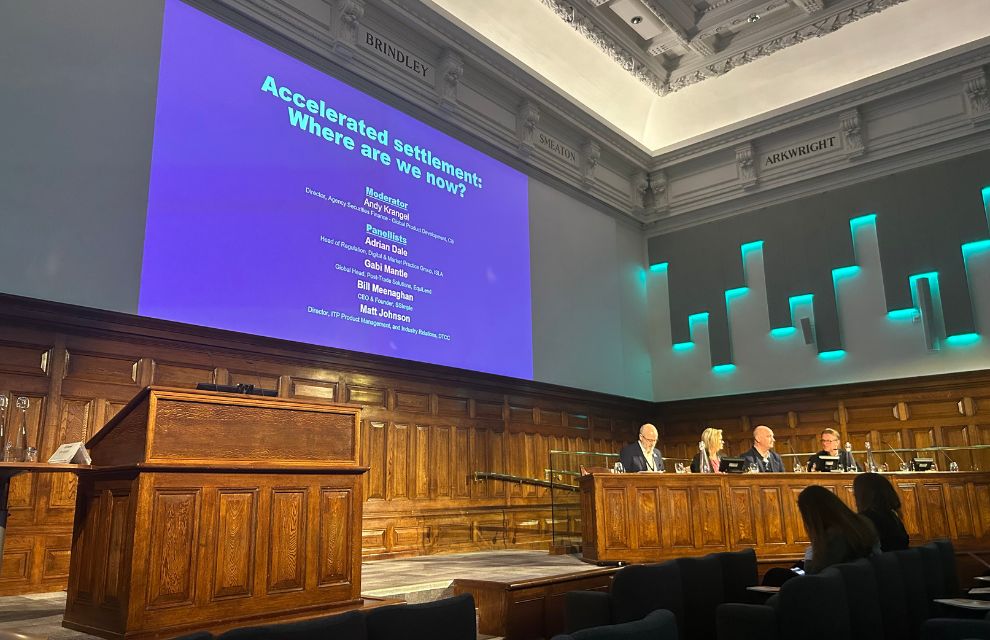

SF Symposium: Collateral tokenisation can support the shift towards T+1

SF Symposium: Collateral tokenisation can support the shift towards T+1

SF Symposium: Automation is key, but T+1 challenges remain

SF Symposium: Automation is key, but T+1 challenges remain

Taskize appoint Adair and Escobedo

Taskize appoint Adair and Escobedo