C3 on CSDR: compliance, controls and expertise you can count on: activate, validate, allocate

31 March 2021

C3 Post Trade quantifies the scale of the challenge posed by CSDR’s SDR and offers advice on how to prepare for strict settlement oversight

Image: Image: vijay0401/stock.adobe.com

Image: Image: vijay0401/stock.adobe.com

CSDR explained

The Central Securities Depository Regulation’s (CSDR) settlement discipline regime is due to come into force on 1 February 2022. CSDR’s goal is to improve the safety and efficiency of securities settlement systems across the European Economic Area (EEA). The location of the settling party is not relevant and therefore firms that are based outside the EEA with trades settling in EEA CSDs and International CSDs (ICSDs) are impacted. UK firms will be impacted where their transactions are settling in EEA CSDs and ICSDs.

There are three pillars:

1. Measures to prevent settlement fails

2. Measures to address settlement fails

3. Measures to monitor settlement fails

Settlements in the UK CSD (Euroclear UK&I) will not be subject to the regime. Again, the location of the settling party is not relevant. Settlement discipline is included in the current European Commission’s consultation on CSDR. The outcome is not yet known but current industry consensus

appears to be:

1. Interest penalties: these will happen

2. Mandatory buy-ins: likely to happen so we urge firms to plan for the worst and hope for the best

What is the impact of CSDR?

The regime has a firm-wide impact, including on the front office and especially if mandatory buy-in requirements don’t change.

• Firms will receive their first fails penalties reports on 2 February 2022

• Those with multiple CSD or custodian relationships will receive a report from each of them

• These reports will show the debit or credit interest associated with each fail

• Interest will then need to be validated and allocated appropriately, in line with internal policies and external regulatory and contractual obligations (such as MiFID)

• Monthly summaries need to be checked back to item-level daily reporting

• For a firm with 250 fails a day this means at least 20 reports and 5,000 interest debits and credits every month. Few will be individually material, but all need to be processed

The first mandatory buy-ins are due a few days later. The timescales for these vary according to the instrument type, liquidity, and trading venue but will usually be after 4 business days (liquid shares) or 7 business days (most

other transactions).

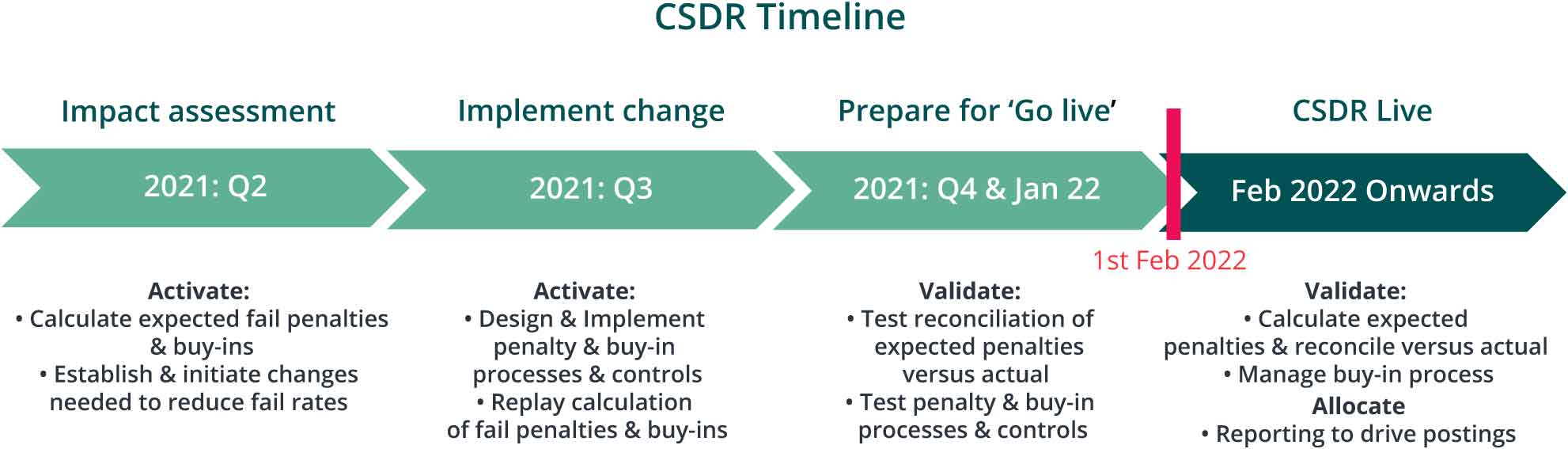

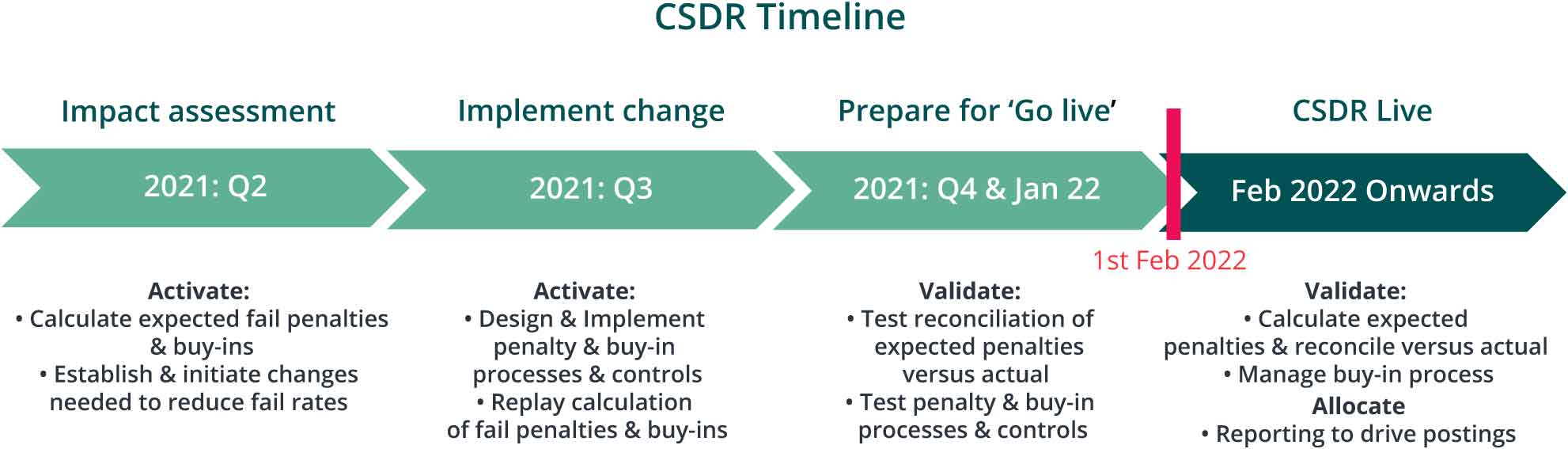

How should firms prepare?

The starting point should be an impact assessment based on an analysis of the expected penalty interest, potential buy-ins, their causes, the impact on clients and the front office, and regulatory and contractual considerations. This will give the basis for determining the size and scope of the project needed and ensure that resources are appropriately allocated across the various workstreams.

Planning and preparation activities can be categorised as:

1. Reducing fails across all impacted business activities (cash trading, repo, stock lending, etc) – fewer penalties, fewer mandatory buy-ins. A trade that settles on ISD (intended settlement date) won’t ever be penalised or bought in. What changes are needed to improve settlement rates and reduce the time to resolve fails?

2. Front office preparation – counterparty/broker performance needs to be reviewed, client impact including contractual changes assessed, etc. How will this be monitored and managed?

3. Processing penalties – we conservatively estimate c.€1.5bn pa total debit and credit interest. These are significant new flows. How are they going to be validated and allocated? How will queries be resolved? Who is going to do this?

4. Processing mandatory buy-ins – these impact a lot of business areas: front office, middle office/fund accounting, settlements, etc. Who will own these and coordinate across the firm?

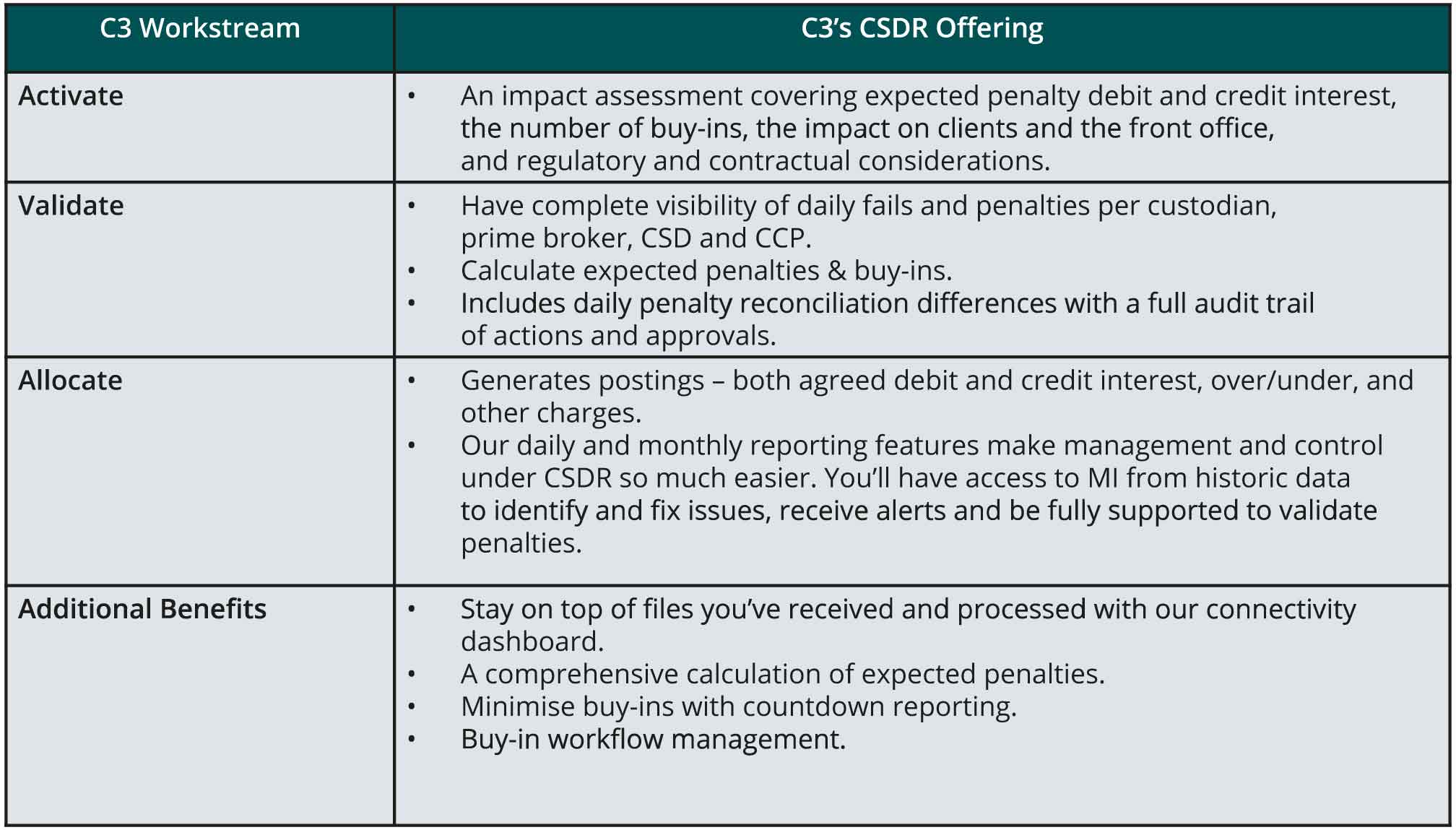

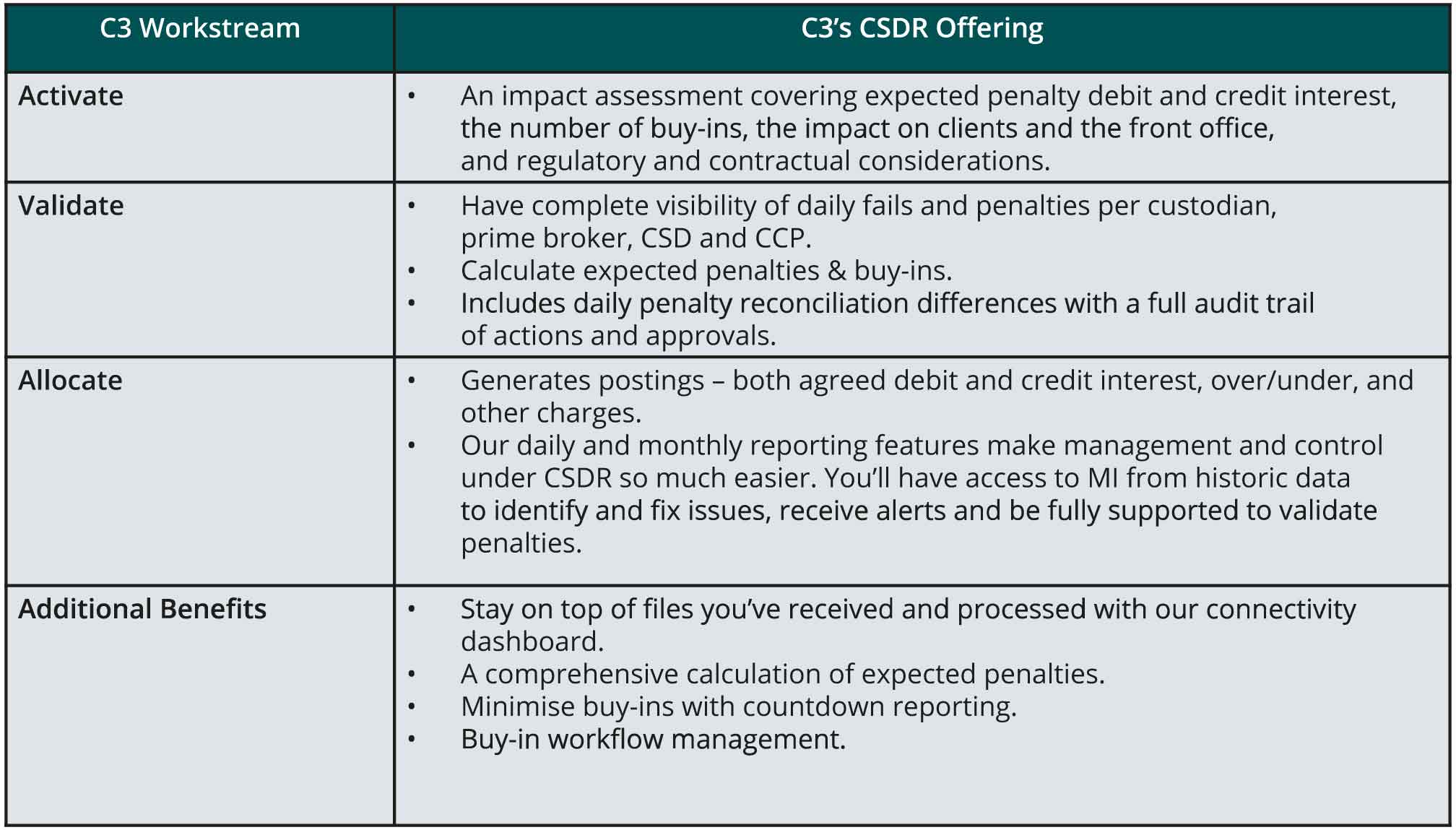

How can C3 help?

C3’s CSDR fully-managed service takes the worry out

of compliance.

We help ensure fewer fails and buy-ins, enable validation and allocation of penalties, and offer a comprehensive audit trail to keep track of everything.

C3 Benefits

• Calculate expected penalty interest and identify potential buy-ins

• Import and track penalty reports from CSDs/ICSDs, CCPs and custodians

• Experience a full audit trail of actions and approvals at your fingertips

• Leverage MI to monitor, manage and control your views

Figure 1

Figure 2

For more information please visit https://c3posttrade.com/services/c3-csdr

The Central Securities Depository Regulation’s (CSDR) settlement discipline regime is due to come into force on 1 February 2022. CSDR’s goal is to improve the safety and efficiency of securities settlement systems across the European Economic Area (EEA). The location of the settling party is not relevant and therefore firms that are based outside the EEA with trades settling in EEA CSDs and International CSDs (ICSDs) are impacted. UK firms will be impacted where their transactions are settling in EEA CSDs and ICSDs.

There are three pillars:

1. Measures to prevent settlement fails

2. Measures to address settlement fails

3. Measures to monitor settlement fails

Settlements in the UK CSD (Euroclear UK&I) will not be subject to the regime. Again, the location of the settling party is not relevant. Settlement discipline is included in the current European Commission’s consultation on CSDR. The outcome is not yet known but current industry consensus

appears to be:

1. Interest penalties: these will happen

2. Mandatory buy-ins: likely to happen so we urge firms to plan for the worst and hope for the best

What is the impact of CSDR?

The regime has a firm-wide impact, including on the front office and especially if mandatory buy-in requirements don’t change.

• Firms will receive their first fails penalties reports on 2 February 2022

• Those with multiple CSD or custodian relationships will receive a report from each of them

• These reports will show the debit or credit interest associated with each fail

• Interest will then need to be validated and allocated appropriately, in line with internal policies and external regulatory and contractual obligations (such as MiFID)

• Monthly summaries need to be checked back to item-level daily reporting

• For a firm with 250 fails a day this means at least 20 reports and 5,000 interest debits and credits every month. Few will be individually material, but all need to be processed

The first mandatory buy-ins are due a few days later. The timescales for these vary according to the instrument type, liquidity, and trading venue but will usually be after 4 business days (liquid shares) or 7 business days (most

other transactions).

How should firms prepare?

The starting point should be an impact assessment based on an analysis of the expected penalty interest, potential buy-ins, their causes, the impact on clients and the front office, and regulatory and contractual considerations. This will give the basis for determining the size and scope of the project needed and ensure that resources are appropriately allocated across the various workstreams.

Planning and preparation activities can be categorised as:

1. Reducing fails across all impacted business activities (cash trading, repo, stock lending, etc) – fewer penalties, fewer mandatory buy-ins. A trade that settles on ISD (intended settlement date) won’t ever be penalised or bought in. What changes are needed to improve settlement rates and reduce the time to resolve fails?

2. Front office preparation – counterparty/broker performance needs to be reviewed, client impact including contractual changes assessed, etc. How will this be monitored and managed?

3. Processing penalties – we conservatively estimate c.€1.5bn pa total debit and credit interest. These are significant new flows. How are they going to be validated and allocated? How will queries be resolved? Who is going to do this?

4. Processing mandatory buy-ins – these impact a lot of business areas: front office, middle office/fund accounting, settlements, etc. Who will own these and coordinate across the firm?

How can C3 help?

C3’s CSDR fully-managed service takes the worry out

of compliance.

We help ensure fewer fails and buy-ins, enable validation and allocation of penalties, and offer a comprehensive audit trail to keep track of everything.

C3 Benefits

• Calculate expected penalty interest and identify potential buy-ins

• Import and track penalty reports from CSDs/ICSDs, CCPs and custodians

• Experience a full audit trail of actions and approvals at your fingertips

• Leverage MI to monitor, manage and control your views

Figure 1

Figure 2

For more information please visit https://c3posttrade.com/services/c3-csdr

NO FEE, NO RISK

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times