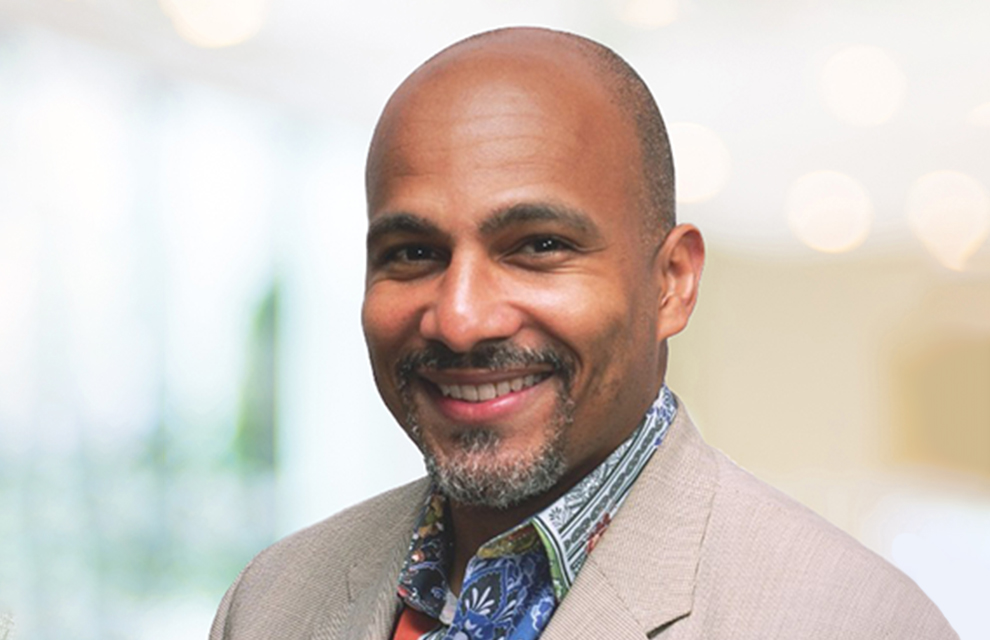

Núñez joins DTCC as chief information security officer

Núñez joins DTCC as chief information security officer

DTCC’s FICC passes $750 billion processing milestone

DTCC’s FICC passes $750 billion processing milestone

R3 releases beta version of new gen Corda platform

R3 releases beta version of new gen Corda platform

Collaboration is key to improve settlement efficiency, WFC speakers agree

Collaboration is key to improve settlement efficiency, WFC speakers agree

CSDs must act to combat evolving risk environment, WFC panellists say

CSDs must act to combat evolving risk environment, WFC panellists say

DTCC partners with Nomura Research Institute

DTCC partners with Nomura Research Institute

DTCC Europe joins Financial Markets Standards Board

DTCC Europe joins Financial Markets Standards Board

DTCC makes trio of leadership appointments

DTCC makes trio of leadership appointments

DTCC’s MF Info Xchange service sees significant increase in distributed event notifications in 2022

DTCC’s MF Info Xchange service sees significant increase in distributed event notifications in 2022

DTCC launches service to support transition from LIBOR benchmark rates

DTCC launches service to support transition from LIBOR benchmark rates

Many market participants remain unprepared for move to T+1, finds The ValueExchange

Many market participants remain unprepared for move to T+1, finds The ValueExchange

Asset servicing industry celebrates International Women’s Day

Asset servicing industry celebrates International Women’s Day